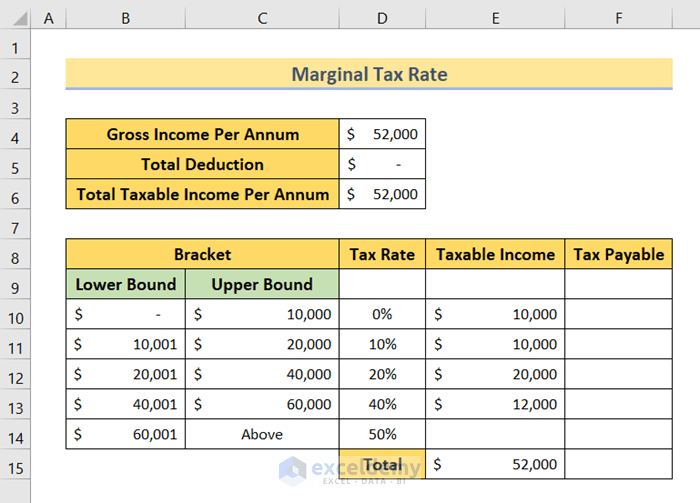

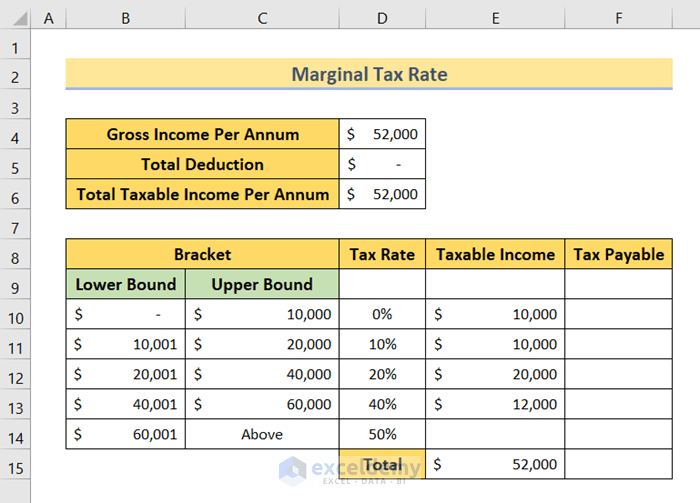

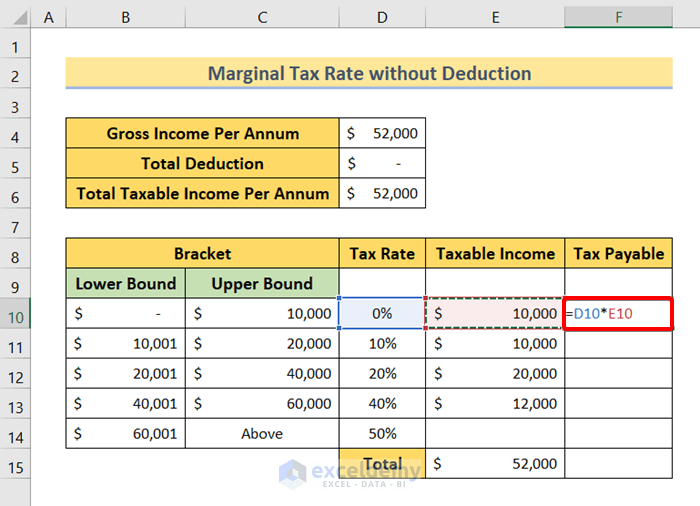

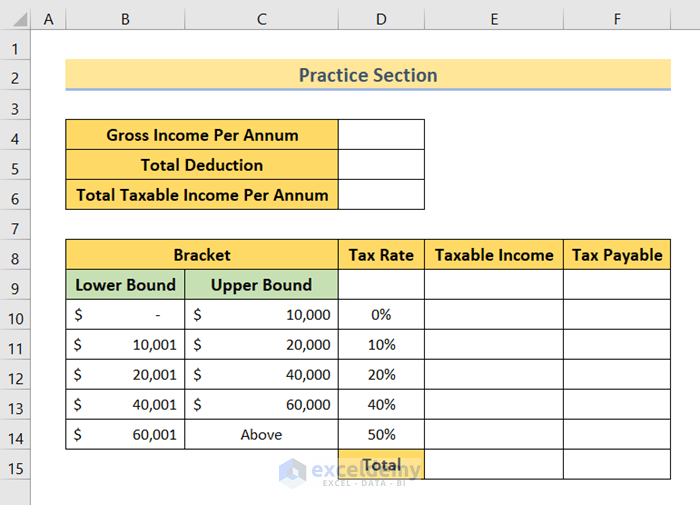

In the following picture, we have a dataset of four columns. The first column is Bracket. This column has two sub-columns, Lower Bound and Upper Bound. We have put some sample tax brackets ranging from $0 to $60,001 and above. The next column is Tax Rate which has all the marginal tax rates ranging from 0% to 50%. The next two columns are Taxable Income and Tax Payable. We will use this dataset to demonstrate calculating marginal tax rates in Excel.

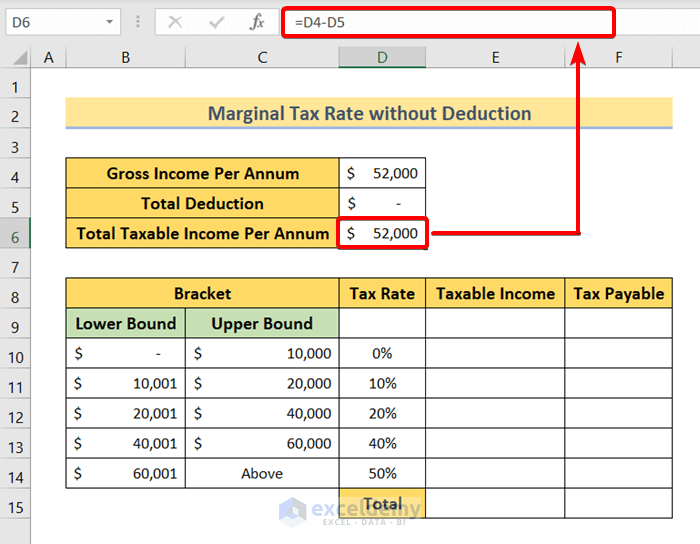

The formula returns the Total Taxable Income Per Annum is $52,000.

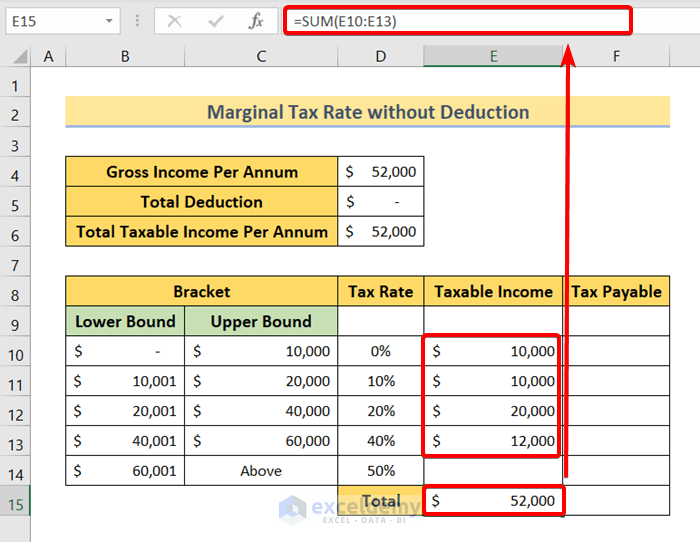

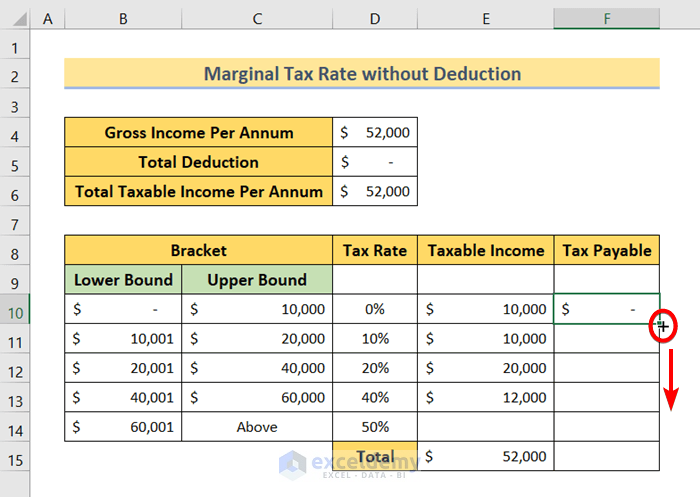

We need to distribute the taxable amount to the corresponding tax brackets.

The formula also returns $52,000. This means the taxable income distribution is okay.

The basic formula for calculating Tax Payable is:

Tax Payable = Tax Rate * Taxable IncomeHere, D10 refers to the Tax Rate and E10 refers to the Taxable Income.

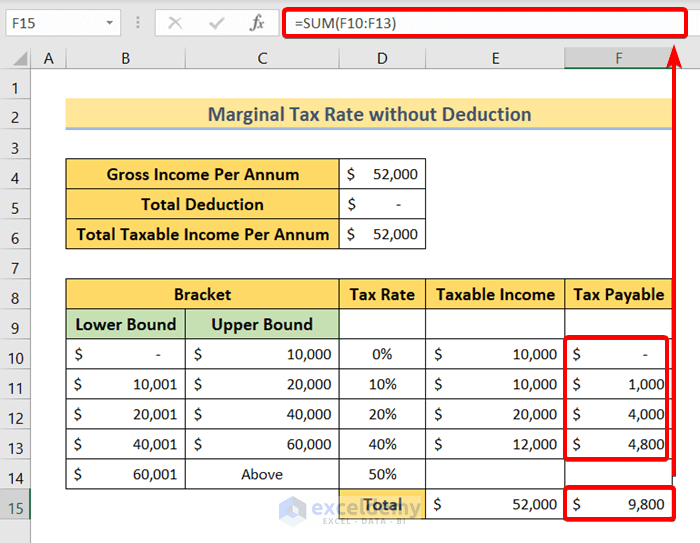

This returns the corresponding Tax Payable amount for all tax brackets.

The total Tax Payable amount is $9,800. So, for a total taxable income amount of $52,000, the marginal tax rate is 40%. It’s because the 4th portion of the Taxable Income falls under the 4th tax bracket of 40% Marginal Tax Rate.

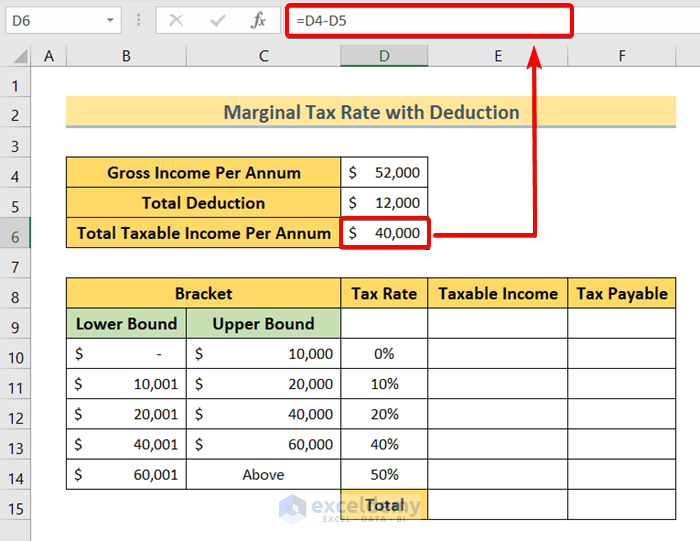

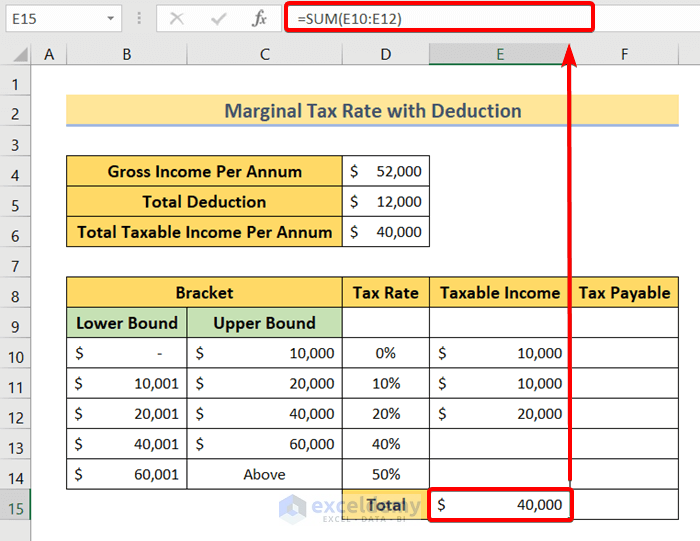

Consider the following:

To calculate the Total Taxable Income Per Annum,

The formula returns $40,000, so the total taxable income per annum is $40,000.

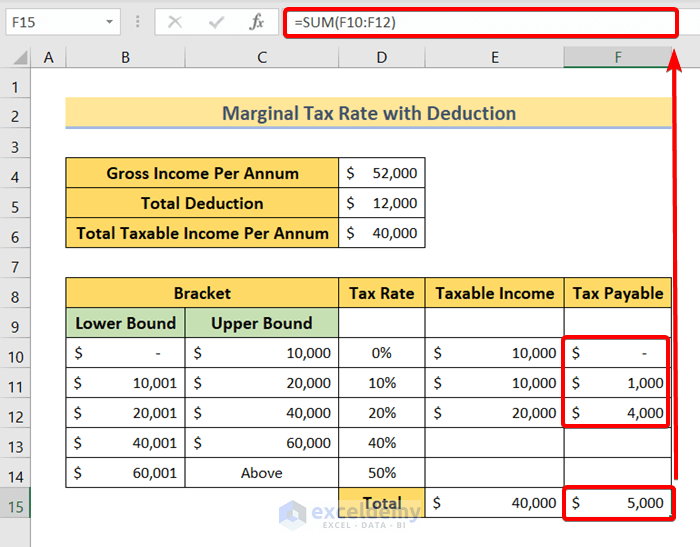

We’re distributing the total taxable income to the brackets.

The formula also returns $40,000. This means the taxable income distribution is okay.

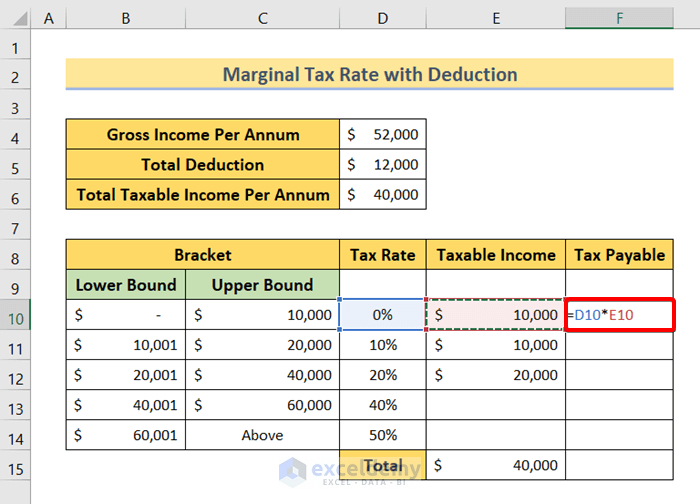

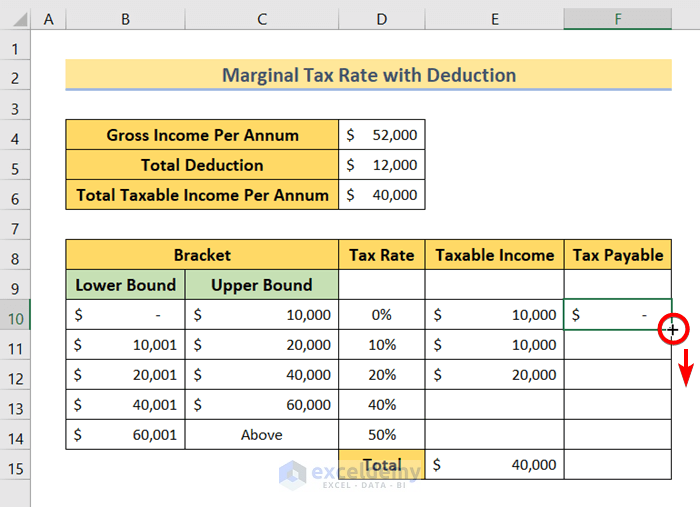

The basic formula for calculating Tax Payable is:

Tax Payable = Tax Rate * Taxable IncomeHere, D10 refers to the Tax Rate and E10 refers to the Taxable Income.

The total Tax Payable amount is $5,000.

You will get an Excel sheet like the following screenshot at the end of the provided Excel file where you can practice calculating the taxes.

Download the Practice Workbook

Marginal Tax Rate.xlsx